Concept of Balance of Payments

A developing country like India generally experiences a deficit balance of payments situation. This is because such a country requires imported machines, technology, other resources & capital to successfully run its economy. A country’s Balance of Payments (BoP) tells a lot about its economic stability & sustainability.

Balance of Payments for Banking – Introduction

Balance of payments is an overall statement of a country’s economic transactions with the rest of the world over some period – usually 1 year. It includes all outflows and inflows (payments and receipts). Countries have either balance of payment surplus or a balance of payment deficit.

Balance of Payment for Banking is a way of listing receipts and payments in international transactions of a country.

Importance of Balance of Payments

A country has to deal with other countries in respect of the following:

- Visible items: which include all types of physical goods exported and imported.

- Invisible items: which include all those services whose export and import are not visible e.g. transport services, medical services, etc.

- Capital transfers: which are concerned with capital receipts and capital payments.

In order to acquire these goods, a country will accommodate some capital deficit and this is called Balance of Payments.

Types of Balance of Payments

Types of Balance of Payments

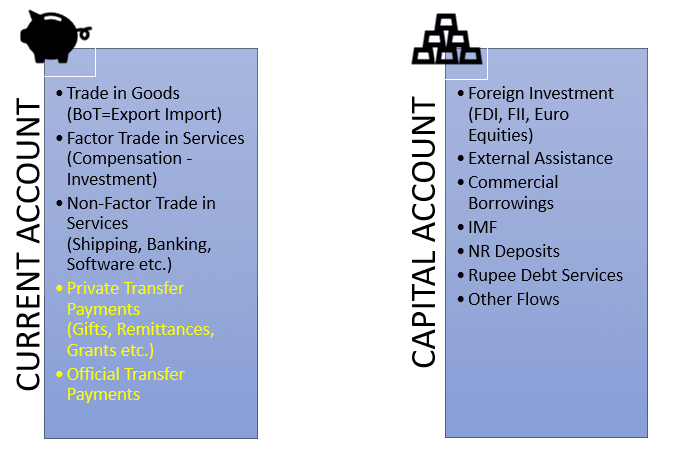

Balance of Payment can be broken down into:

- The Balance of Trade (export and import of goods)

- A Balance of Current Account (includes the balance of trade, the balance of services and remittances)

| Balance of Payment (BoP) | Balance of Trade |

| 1. It is a broad term | 1. It is a narrow term |

| 2. Includes all transactions related to visible, invisible and capital transfers | 2. Includes only visible items |

| 3. Always balances itself | 3. Can be favorable or unfavorable |

| 4. BOP = Current Account + Capital Account + or – Balancing item (Errors and Omissions) | 4. BOT = Net Earning on Export – Net payment for imports |

| 5. Following are the main factors which affect BOP

a. Conditions of foreign lenders |

5. Following are the main factors which affect BOT

a. Cost of production |

- Capital Account (investment and borrowing): The capital account of a country consists of its transaction in financial assets in the form of short-term and long-term lending and borrowing.

Trade is a part of the current account. Capital account deals with investment and borrowings and the rest of the BOP is the current account of which foreign trade is a part.

Balance of Payments Vs. Balance of Trade

Invisibles & Remittances

Balance of payments and Invisibles:

- ‘Invisibles’ in international trade is used as a synonym for service. Invisibles trade is a ‘trade-in service’.

- ‘Visible’ in international trade is used as a synonym for goods. Visible trade is a trade in goods.

- Invisibles are divided in three parts i.e. services, transfers and incomes.

Remittances (भेजी गई रक़म): In recent months, the value of rupee has weakened considerably in comparison to the dollar and a rise in remittances is expected as non-resident Indians (NRI) take advantage of cheaper goods, services and assets back home. Indian diaspora, which is one of the most prosperous in the world is sending money home. Controls are lifted and so there are greater inflows. The government has progressively reduced the red tape (excess documentation). Interest rates are high thus, RBI increased the amount that can be remitted home.

Convertibility of Rupee

Convertibility refers to the freedom of the holder of domestic currency to freely convert it into any other foreign currency. It has 3 dimensions:

- Freedom to convert

- Convert at market rate

- Removal of restrictions for conversion on current and capital account

Equilibrium& Disequilibrium

Equilibrium: When demand for and supply of foreign currency in a nation in a given period are equal, it is viewed as ‘Equilibrium Position’ in BOP.

Disequilibrium: Disequilibrium in balance of payment means its condition of surplus or deficit. A surplus in BOP occurs when total receipts exceed total payments and a deficit in BOP occurs when total payments exceed total receipts.

Causes of Disequilibrium

- Natural causes: Floods, earthquakes, etc.

- Economic causes: Cyclical fluctuations, Inflation, Demonstration effect, etc.

- Political causes: International relation, Political instability, etc.

- Social factors: Change in taste and preferences etc.

- Population growth

- Development Programmes

- Demonstration Effect

- Poor Marketing Strategies

- Flight of capital

- Globalization

How to Correct the Balance of Payment?

- Monetary measures

- Monetary policy

- Fiscal policy

- Deflation

- Exchange rate Depreciation

- Devaluation

- Exchange control

- Non – Monetary measures

- Export Promotion

- Import Substitutes

- Import Control

→ Quotas

→ Tariffs