National News:

1.Finance Minister Piyush Goyal asked the public sector banks to provide more loans to micro, small and medium enterprises, agriculture and residential areas. :- Increase measures to meet the debt related needs of areas like farming and housing. He was speaking to the media after his first review meeting with the CEOs of public sector banks in New Delhi yesterday. He said that loan disbursement inefficiency and bankruptcy law have helped the public sector banks recover the immoveable debt of Rs one lakh crore in the nine months of the current financial year. The measures taken by the government to improve the banking system are better In view of the results, the Finance Minister asked the banks to make sure that the benefits achieved in the recent past should be maintained. And all customers said Jaankunhonne to provide better services to the banks should also be committed to providing funds under the Prime Minister’s residence scheme. The goal of this program is to provide houses for all by 2022.

Increase measures to meet the debt related needs of areas like farming and housing. He was speaking to the media after his first review meeting with the CEOs of public sector banks in New Delhi yesterday. He said that loan disbursement inefficiency and bankruptcy law have helped the public sector banks recover the immoveable debt of Rs one lakh crore in the nine months of the current financial year. The measures taken by the government to improve the banking system are better In view of the results, the Finance Minister asked the banks to make sure that the benefits achieved in the recent past should be maintained. And all customers said Jaankunhonne to provide better services to the banks should also be committed to providing funds under the Prime Minister’s residence scheme. The goal of this program is to provide houses for all by 2022.

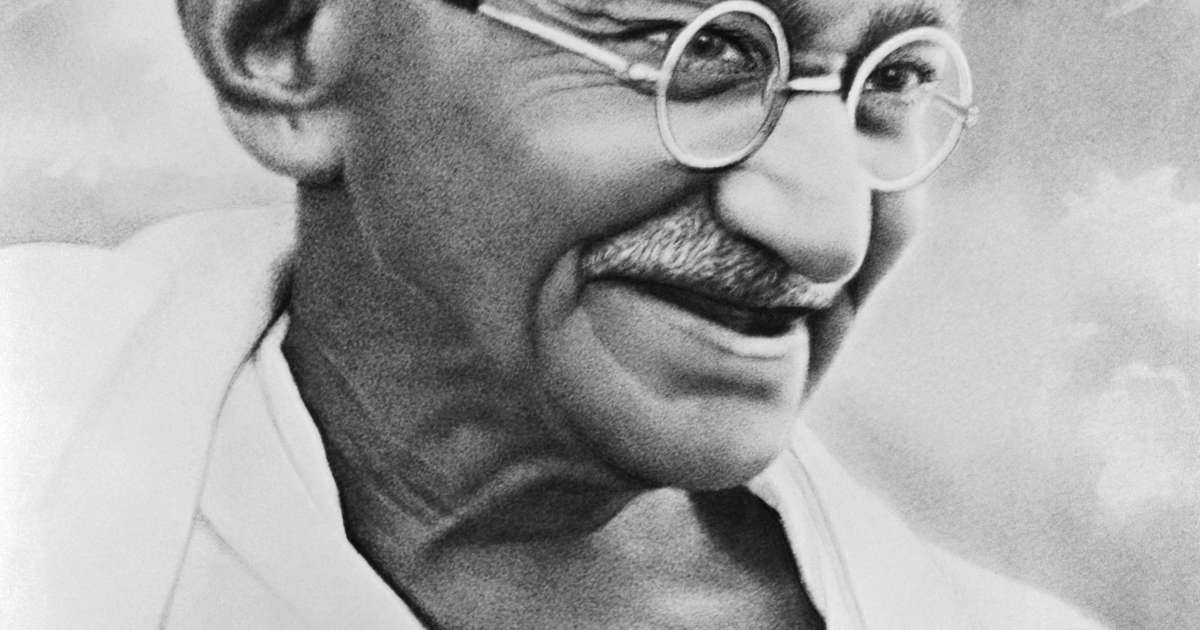

2.Here is the continuous celebration of Gandhiji’s thirteenth century, an unheard of story:-

With Rameshwar of Sheopur, Gandhiji’s triadashi is also organized in Orchha, Barwani, Mathura. There is a big program in Rameshwar.

International News:

3.Venezuela issued alternative currency exchange:- Venezuela launched a market-based an alternative currency exchange system on Monday, in which the price of the national currency Bolivar fell to 35 percent on the first day of trading. Tweeted by the Central Bank of Venezuela, it was said that the private platform ‘Interbanex’ was officially Has become part of the country’s currency exchange system, which has got the necessary permit from the regulator. According to the interbank, US Dollar until January 28 Price was 3200 Bolivar while the exchange rate in the official decome exchange system was 2081 Bolivar.

Venezuela launched a market-based an alternative currency exchange system on Monday, in which the price of the national currency Bolivar fell to 35 percent on the first day of trading. Tweeted by the Central Bank of Venezuela, it was said that the private platform ‘Interbanex’ was officially Has become part of the country’s currency exchange system, which has got the necessary permit from the regulator. According to the interbank, US Dollar until January 28 Price was 3200 Bolivar while the exchange rate in the official decome exchange system was 2081 Bolivar.

Business News:

4.No relief for common man on Wednesday, diesel price hike:-There was no change in the price of petrol and diesel on Wednesday . The price of one liter of petrol in the national capital of Delhi is Rs 71.19 . At the same time, diesel is at a price of Rs 65.89 per liter . One liter petrol in Mumbai is 76.82 and diesel is sold for Rs 69 . On Wednesday, the price of one liter petrol in Kolkata is 73.28 and diesel is 67.67 rupees, while in Chennai one liter petrol is priced at 73.90 and diesel is priced at Rs 69.61 a liter .

Significantly, the price of petrol and diesel was seen on Tuesday after January 5 . Petrol prices were reduced by 8 paise a liter on Tuesday and 11 paise less on diesel .

5.IndusInd Bank Launches Payback Credit Card:- IndusInd Bank announced on Tuesday that it will launch co-branded credit card ‘IndusInd Bank Payback Credit Card’ in partnership with multi-brand loyalty program payback. The bank said in a statement that with IndusInd Bank Payback Credit Card, customers will not only receive payback points on all transactions on co-branded credit cards, but in-store and online transactions done in more than 100 payback partner brands, You will also get additional payback points on the transaction.

IndusInd Bank announced on Tuesday that it will launch co-branded credit card ‘IndusInd Bank Payback Credit Card’ in partnership with multi-brand loyalty program payback. The bank said in a statement that with IndusInd Bank Payback Credit Card, customers will not only receive payback points on all transactions on co-branded credit cards, but in-store and online transactions done in more than 100 payback partner brands, You will also get additional payback points on the transaction.

All points earned in the customer’s card account will be transferred to the customer’s payback account and then can be redeemed for exciting options such as food, shopping, entertainment, travel bookings. Card operates through Visa’s ‘paywave’ technique, which enables customers to make payments by showing the card near the merchant terminal.

6. Trouble is done in maintaining Minimum Balance in the account, these accounts of SBI are for your work:- According to State Bank of India Minimum Balance Rule or Monthly Hours Balance Rules, you have to maintain a minimum amount to maintain your account. Penalties are taken from you if not done. SBI has recently updated the Average Monthly Balance Rule which is applicable to regular savings accounts.

According to State Bank of India Minimum Balance Rule or Monthly Hours Balance Rules, you have to maintain a minimum amount to maintain your account. Penalties are taken from you if not done. SBI has recently updated the Average Monthly Balance Rule which is applicable to regular savings accounts.

However, SBI also offers some special types of savings accounts in addition to where the mandatory average balance requirement is not applicable. In these accounts the account holder does not need to maintain any amount and the account remains on the bank side.

Know which categories of SBI’s Average Monthly Balance (AMB) does not apply-

A.) No Frills Account: In November 2005 banks were advised that they would make available to the users no-frill accounts or accounts with minimum balance or minimum balance. These are such accounts where there is no compulsion to keep the minimum balance, you can keep it running even while keeping zero balance in it. A no-frill account is also called the Basic Savings Bank Deposit Account and it is made available to all for normal banking services.

B.) Salary Package Account: SBI offers many types of salary accounts in line with the needs of the customers. SBI’s Special Salary Account is available for various sectors like Central Government, State Government, Defense Force, Paramilitary Force, Police Force, Industrialist / Institute etc. These packages can be opened with Zero Balance.

C.) Basic Savings Bank Deposit Account: Basic Savings Bank Deposit Account (BSBDA) is a special scheme introduced by the Central Government and the Reserve Bank for the general public. It is aimed at bringing about the number of no-frills accounts opened in the country to bring banking services to the poor, under the scope of this scheme. It is also called zero balance account. In this, the bank takes care of the general needs of the customers through the free ATM, monthly statement and check book.

The specialty of this account is facilities such as Savings, Credit and Money Transfer Facilities and simple KYC regulations, such as ATM less debit cards. Under this, account can be opened and maintained with zero balance.

D.) First Step and First Flight Account: These savings accounts are specially made for children. It not only teaches them the importance of saving but also gives them the opportunity to use the ‘shopping capacity’ of the money. Minimum average balance maintenance is not mandatory for customers in these accounts.

E.) Prime Minister Jan Dhan Yojna (PMJDY): Prime Minister Jan Dhan Yojana is an initiative of financial inclusion. Its aim is to bring the people deprived of banking services under the formal banking system. Under this scheme, accounts with zero balance facility are opened. The Jan Dhan Yojana was started by Modi Government in August 2014. The first phase of this phase was completed in August, 2015. During this period, the main objective of the government was to open the general bank accounts of the people and to equip them with a RIS card. In the last four years, the account of Prime Minister Jan-Dhan Yojana has an outstanding balance of Rs 80,674.82 crore.

Sport News:

7.Ind vs NZ: Indian women did amazing, win second ODI, win series by New Zealand:- Indian women’s cricket team defeated New Zealand by eight wickets in the second one-day match at the Bay Oval ground on Tuesday. With this win, the Indian team has made an unbeatable 2-0 lead in the three ODIs. In this match, Indian captain Mithali Raj gave victory to the last ball with a six.

Indian women’s cricket team defeated New Zealand by eight wickets in the second one-day match at the Bay Oval ground on Tuesday. With this win, the Indian team has made an unbeatable 2-0 lead in the three ODIs. In this match, Indian captain Mithali Raj gave victory to the last ball with a six.